The Buzz on Getting Health Insurance at Work - American Cancer Society

Employer Group Insurance - Vantage Health Plan for Dummies

Getting a group health insurance of any kind is beneficial for both you and your employees. Spend some time to investigate your health insurance coverage choices to learn what will work best for your organization. If you have an interest in an HRA for your organization, Individuals, Keep can help!. This post was initially published on March 13, 2020.

Picking reliable, sustainable medical insurance coverage for your business helps build a solid structure for stabilizing expenses and focusing on care for your workers. With United, Health care, you'll find a wide variety of group health insurance prepare for big and small businesses, with a concentrate on using a much better experience for companies and employees alike.

Employer Bulletin: Consider Participating in the Wisconsin Public Employers Group Health Insurance Program - ETF

Page Last Examined or Updated: 23-Nov-2021.

Top 10 Money-wasters for Group Health Insurance Benefits - by Bruce Brielmaier - Medium

The Ultimate Guide To Employer and group health insurance plans - Regence

We provide healthcare plans of all types, for companies large and small. One size does not fit all. We can tailor your health insurance to your group's requirements and your business's budget plan. From group health coverage copays to deductible options, we have actually got you covered. Wherever your organization is situated, we have a plan that will provide you access to the network of medical professionals you require in your area.

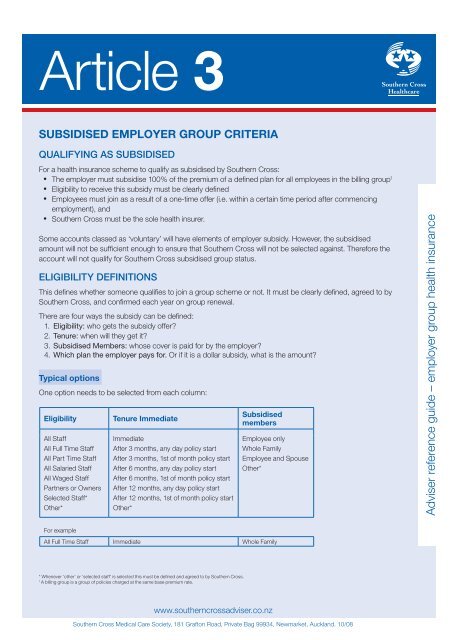

Many employers or employee associations offer health insurance coverage to their staff members. In truth, the Affordable Care Act needs employers with more than 50 full-time comparable employees to use health coverage that fulfills specific minimum requirements. Smaller companies might use insurance coverage too. Employer-sponsored medical insurance is selected and purchased by your employer and used to eligible staff members and their dependents.

Your employer typically splits the expense of premiums with you. Your part of the premium might be instantly subtracted from your paycheck each pay duration. Premium contributions from your employer are not subject to federal taxes, and your contributions can be made pre-tax, which lowers your taxable earnings. Your employer supplies policy documents and responses questions about your strategy.